hello friends !! Here is the summary of extended due date due to Covid-19.now it is 30 november 2020 for an individual.also, the Interest under section 234A has been waived off whereself-assessment tax is up to Rs 1 Lac. followings are the details regarding various taxpayers : stay tuned .. Gaurav Bohra.

Tag: itr

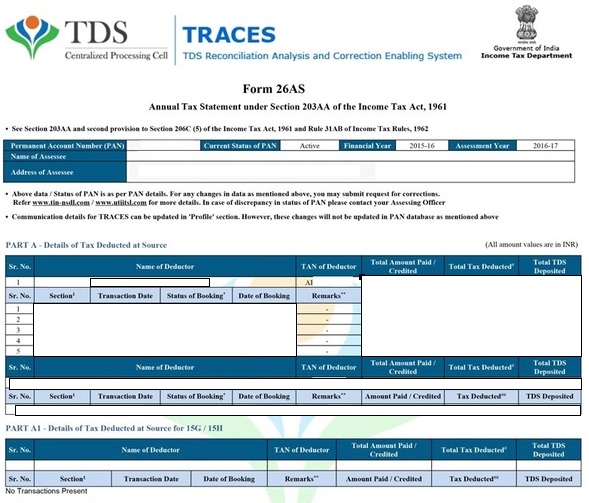

Issue Involved : You must be aware that, for an individual, ITR filing deadline is the july31st. i am assuming that you are standing at somewhere around middle of this july month. your form 16 is showing TDS deducted but, in fact, the same is not reflected in the form 26AS. what to do now … Read More “your 26AS is not showing TDS ? then how to file an ITR…” »

To make the return filing process easier for individuals, this year the tax department will be providing ITR-1 pre-filled with salary, FD-interest income and TDS details. These details will be pre-filled in ITR1 only for forms filed online. These fields are editable and you will be able to correct the figures auto-filled in case of … Read More “Pre-filled data in ITR 1” »