hello friends !! Here is the summary of extended due date due to Covid-19.now it is 30 november 2020 for an individual.also, the Interest under section 234A has been waived off whereself-assessment tax is up to Rs 1 Lac. followings are the details regarding various taxpayers : stay tuned .. Gaurav Bohra.

Category: taxation

if someone wants to establish a new business undertaking in india, he should mainly take care of section 32 inter-alia, 32AD,35AD,10AA and 115BA. below is the link of my notion note explaining which provisions of the income tax act of india are applicable to him. https://www.notion.so/New-business-undertaking-in-2020-f494dbca367b41a2a2d5fd48c003fe14

I am talking about some of the Basic things, which you should know before proceeding for E-way Bill under GST, E – way bill is a document issued by carrier having details of shipment of consignment of goods and details of consignor & consignee. this helps in monitoring and tracking movement of goods. Section 68 … Read More “All about E-way Bill.” »

Indian business houses are setting up family trusts in places like Malta and Dubai to keep their money safe. A business family based in New Delhi, with interests ranging from real estate to infrastructure, recently set up a family trust in Malta, Europe. The family trust has around 20 beneficiaries. The family, whose estimated net … Read More “New Tax Havens.” »

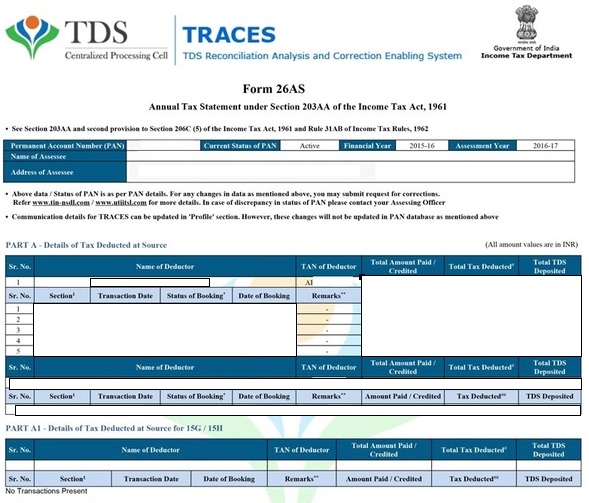

Issue Involved : You must be aware that, for an individual, ITR filing deadline is the july31st. i am assuming that you are standing at somewhere around middle of this july month. your form 16 is showing TDS deducted but, in fact, the same is not reflected in the form 26AS. what to do now … Read More “your 26AS is not showing TDS ? then how to file an ITR…” »

The government has handed out the task of firming up modalities for faceless or anonymous verification, scrutiny and assessment. Faceless assessment or scrutiny would simply mean that-A taxpayer would not have to interact in person with a tax officer. And, A taxpayer would not have to interact in person with a tax officer. And, … Read More “Now Faceless Assessment” »

To make the return filing process easier for individuals, this year the tax department will be providing ITR-1 pre-filled with salary, FD-interest income and TDS details. These details will be pre-filled in ITR1 only for forms filed online. These fields are editable and you will be able to correct the figures auto-filled in case of … Read More “Pre-filled data in ITR 1” »