The Reserve Bank of India (RBI) announced on May 19, 2023 that it would be stopping the issuance of 2000 rupee notes. The decision was made in an effort to curb the circulation of black money and counterfeit notes. The withdrawal of 2000 rupee notes has had a number of effects on the Indian economy, … Read More “The Impact of Stopping 2000 Rupee Notes in India” »

Author: admin

Tax rates, both corporate and individual, remain unchanged. However, there is a relief to Senior Citizens aged 75 year and above, who get pension and earn interest from deposits will not be required to file an income tax. The reopening window for IT assessment – -The time limit has been reduced to 3 years from … Read More “Union Budget 2021 Highlights” »

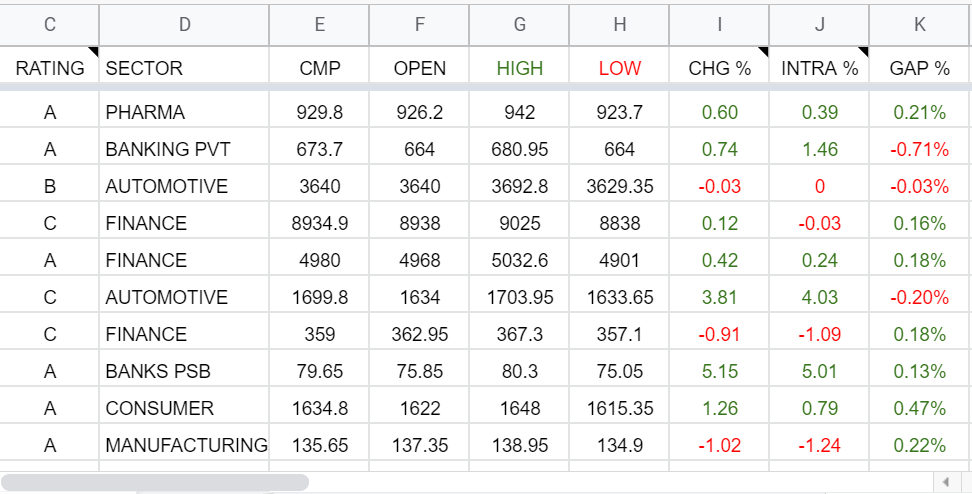

today, i am gonna share this beautiful stock sreeener with you and he some below mentioned significant features of this particular google sheet :hisdslkdSharing with you an amzaing stock screener in google sheet format, hi guyz please do check out all the below mentioned links :pleaseubscribe to this channel. click here to start using the … Read More “Stock Screener” »

“https://bit.ly/39Ab2WL“. hope it helped,Stay in touch. Gaurav Bohra.

Hello friends, First of all, thank you so much to each one of you for the lovely responses, here, i am back with another very short and crisp video. Which basically explains when to enter into a trade. Believe me, after watching this out, you will have the clear-cut levels in your hand, to put … Read More “RSI Indicator.” »

well, if your purpose is to trade by taking deliveries of shares, i.e. other than intra-day. which indeed called as an Investment be it long-term or short-term. it doesn’t matter not having all of the sector specific shares at once in your portfolio,what require is to just keep a track on this time to time … Read More “Tracking The Portfolio – “Paper Trading.”” »

hello friends !! Here is the summary of extended due date due to Covid-19.now it is 30 november 2020 for an individual.also, the Interest under section 234A has been waived off whereself-assessment tax is up to Rs 1 Lac. followings are the details regarding various taxpayers : stay tuned .. Gaurav Bohra.