Issue Involved :

You must be aware that, for an individual, ITR filing deadline is the july31st. i am assuming that you are standing at somewhere around middle of this july month. your form 16 is showing TDS deducted but, in fact, the same is not reflected in the form 26AS. what to do now ? (please read this entire article carefully)

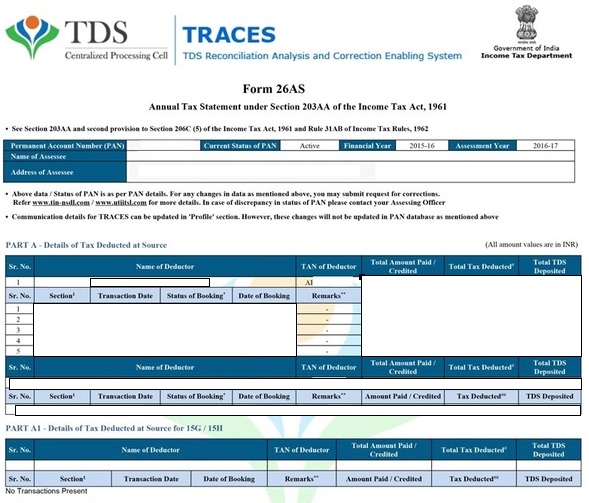

26AS is a TAX CREDIT STATEMENT, that shows History of tax deducted at source in the entire Year.

Reasons :

Possible Reasons for this mismatch may be because of,

- Deductor has not deposited the TDS amount to the government account.

- Deductor has funished wrong PAN, Not furnished PAN or

- furnished wrong particulars.

Possible solution :

one is, to pay self assessed tax and get out of it. second one is ;

Ask your deductor to revise and submit TDS/TDS return then only it will reflected in your Form 26AS. Submit an application for Rectification under Section 154(1)of the Income Tax Act, 1961.

After making sure that employer has furnished the revised return, it wil take some time (30-45 days) to get reflected in 26AS, meanwhile, you may go for return filing ITR.

So,File the ITR and claim the TDS, according to your form 16.the TDS amount which is not same as in your 26AS, means the amount, for which your Deductor has been filed Revised Return as explained above.

now here it comes the catch,

A).If you e-sign your ITR through EVC ie OTP linked to your aadhar, it will start assessment proceedings automatically.

since 26AS is has not been updated yet, system will generate the difference in section 143(1) and will raise a demand against you to pay within 30 days U/s 156(1) .

the resort for you is to file a complaint/grievance with the department in response,

To support your grievance, you must also attach the following proofs:

1. Salary slip showing deduction of TDS;

2. Copy of Form 26AS not reflecting the deposit of TDS;

3. Copy of letter written to your employer pointing out the discrepancy;

4. Form 16, if available.

you will have the option to file an appeal to the Commissioner of Income Tax [Appeals]. The commissioner will decide the case on the basis of the facts of the case.

B).Another option is to choose the option to send physical signed copy of your ITR V.

you will have time period of 120 days to send that copy, since your TDS return-revision is under process & it will reflect in 30-45 day in your 26AS.

once it is reflected, you can send the copy of ITR V or e-sign later (even if earlier you have chosen for sending the physical copy ), you will not get any Demand in this consequence.

Kudos!

Hope it helped.

Thank You.

happy readings !!!

stay tuned…

Gaurav Bohra